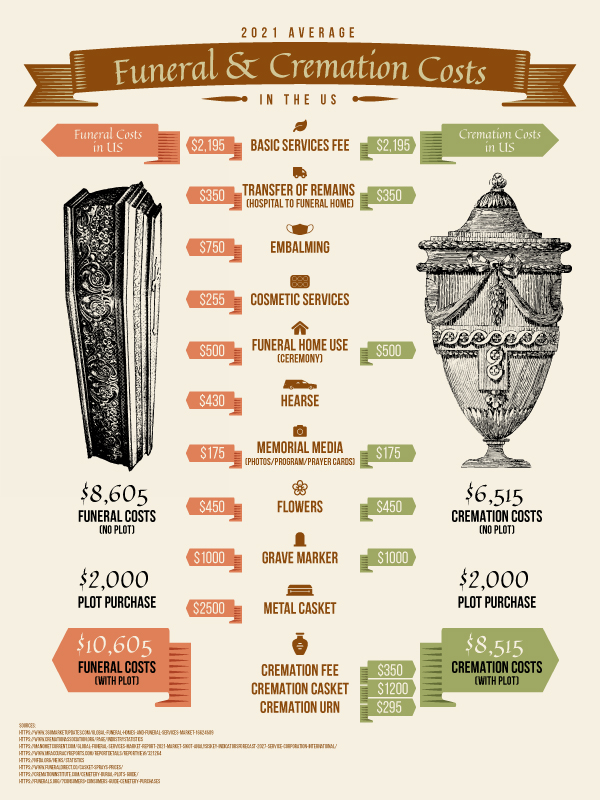

The grief of losing someone can sometimes be made worse by the financial stress that is caused. If your loved one did not financially plan for their death (i.e. no savings or life insurance), it could be up to you to cover the costs. One of the biggest costs is the funeral, which on average can cost over $10,605 for a burial and $8,515 for a cremation! The infographic below breaks down the individual costs.

Finances

You may be wondering how you can afford to pay such a sum of money. Fortunately, there are many options to explore. It’s important to weigh up these options and not let grief drive you to make reckless decisions.

First, gather together any funds from the loved one’s bank account or assets that you have access to. Even if you can only scrape together a few hundred dollars, it’s money that can help to reduce the funeral bill.

Next, see what funds you can get from other people. Friends and family may be willing to put their hands in their pockets and relieve some of the burden. You may even be able to rely on the generosity of strangers via crowdfunding.

Government Support

There may be federal or state financial support that you can also apply to. Some charities in your area may also be able to offer funding if you are on a low income.

Loans should be a last resort. You may be able to find specialist low-interest and even no-interest funeral loans out there. Choose these over regular loans.

Finally, consider which expenses are really necessary. $10,605 may be the average cost of a burial, but you can still put on a great funeral for less than this.

Final Expense Direct covering Funeral Costs